Itochu (8001): Why Buffett Loves this “Non-Resource” King (And You Should Too)

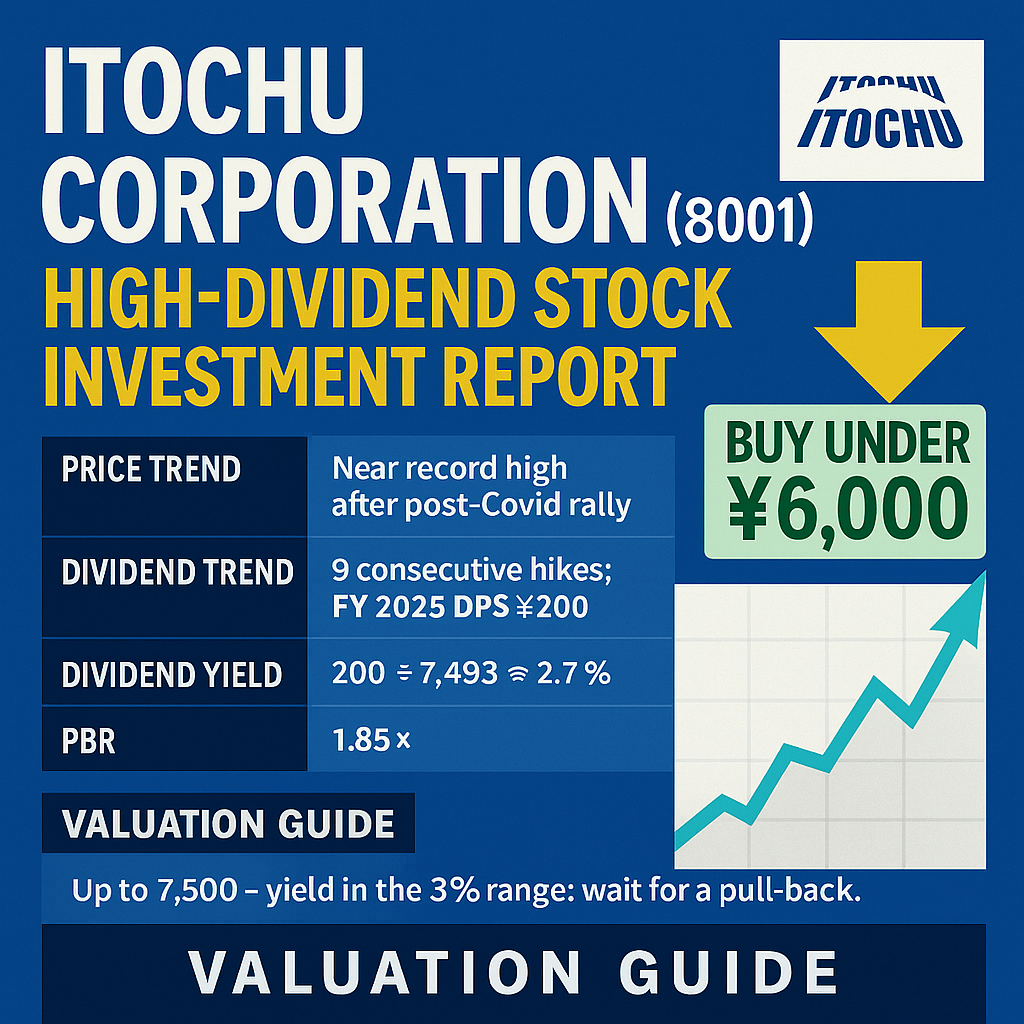

| Metric | Current Status | Comment |

| Price Trend | Near record high after post‑Covid rally | Valuation feels rich at the top end |

| Dividend Trend | 9 consecutive hikes; FY 2025 DPS ¥200 | Progressive policy publicly stated |

| Dividend Yield | 200 ÷ 7,493 ≈ 2.7 % | 4 % yield reached at ¥5,000 |

| PBR | 1.85 × | Book value commands a premium |

| Outlook | FY 2026 net profit target of ¥900 bn / ROE 12 %+ | Growth driven by non‑resource & retail |

Valuation Guide

- Up to ¥7,500 – yield in the 2 % range: wait for a pull‑back.

- Low ¥6,000s – yield in the 3 % range: can accumulate gradually.

- Around ¥5,000 – 4 % yield: strong long‑term buy zone.

Note for Overseas Investors

Japanese trading houses such as ITOCHU prioritise steadily rising dividends rather than large buy‑backs. Yield only becomes compelling after corrections, so entry timing matters more than with many Western income stocks.

② Business Structure & Brand Strength

2‑1 Corporate Overview

Founded in 1858 as a textile wholesaler in Tokyo’s Azabu district, Itochu is now dual‑headquartered in Tokyo and Osaka and listed on the TSE Prime (ticker 8001). Despite a lean headcount of ~4,200 (parent basis) and paid‑in capital of ¥253.4 bn, it generated FY 2025 revenue of ¥14.6 tn and net profit of ¥880.3 bn, ranking among the most profitable sōgō shōsha. Its long‑standing “downstream‑focused” strategy underpins a high‑ROE profile.

2‑2 Core Businesses & Sales Mix (FY 2025, ¥ bn)

| Segment | Sales | Share |

| Textiles | 1,118.6 | 7 % |

| Machinery | 1,906.5 | 13 % |

| Metals | 2,878.0 | 20 % |

| Energy & Chemicals | 3,369.6 | 23 % |

| Food | 2,674.8 | 18 % |

| Living & Real Estate | 1,607.3 | 11 % |

| ICT & Financial | 841.0 | 6 % |

| Other / Adjustments | 191.0 | 2 % |

Note for Overseas Investors

Itochu deliberately limits commodity exposure by expanding stable cash‑flow businesses such as convenience stores (FamilyMart) and ICT services.

2‑3 Competitive Advantages & Brand Value

By doubling down on downstream, consumer‑facing areas—textiles, retail, etc.—Itochu captures higher value‑add. The firm tops Japan’s graduate employer rankings six years running; its culture values “individual capability,” driving high engagement. The full roll‑out of FamilyMart post‑takeover is cited as a success story.

2‑4 Employee Perspective & Shareholder Base

Itochu scores the highest among trading houses on OpenWork for compensation and autonomy, while employees accept demanding workloads. Domestic institutions and pensions dominate the share register; founding‑family or government stakes are minimal. A result‑oriented pay scheme and progressive dividend policy reinforce governance.

③ Share‑Price Performance & Market View

Key Takeaway

While Itochu’s up‑trend remains intact, the stock entered a ¥6,500–7,500 trading range after printing a record high around ¥7,700 in spring 2025. Near term, fresh catalysts are needed, but progressive dividends and solid non‑resource earnings cap the downside, offering further upside potential mid‑term.

3‑1 Five‑Year Price Timeline (highlights)

- Mar 2020: Covid crash to ¥1,700s

- Dec 2021: Commodity boom & record profits lift shares above ¥3,000

- Aug 2023: FamilyMart integration + massive buy‑back hopes break ¥5,000

- Mar 2025: DPS hike streak + FY guidance spark surge to ¥7,700

3‑2 Price‑Moving Events

- May 2021: Big year‑end dividend hike → +12 % (weekly)

- Oct 2022: Oil & coal slump → –15 % (monthly)

- May 2024: ¥300 bn extra buy‑back → +8 % (daily)

- Feb 2025: Q3 earnings beat +18 % YoY → new high

3‑3 Valuation Evolution

- PER: 7× (2020) → 11× (current) as foreign flows lifted multiples

- PBR: 0.8× → 1.8×

Historical context: PER 9× × EPS ¥650 ≈ ¥5,800 marks a “cheap” signal.

3‑4 Current Setup & Sentiment

With the Nikkei at record levels, volume has thinned on valuation fatigue. Watch ① further shareholder‑return announcements, ② North American retail expansion, ③ commodity trends for the next breakout cue. Confirmation of a floor near ¥6,500 would revive the up‑move.

Tip: Plotting earnings releases and buy‑backs on a chart helps retail investors link events to price swings.

④ Growth Potential & Risk: A Credible Long‑Term Bet?

Key Takeaway

Itochu’s consumer‑leaning, non‑resource mix supports “steady growth + high ROE.” Yet commodity, FX and geopolitical swings still matter; prudent entry price and portfolio diversification are essential for long‑term holders.

4‑1 Medium‑Term Plan (extract)

- Target ¥1 tn net profit & 14 % ROE by FY 2027

- Focus areas: ① downstream food & healthcare, ② North American retail (1,000 stores), ③ renewables

- Maintain 40 %+ total payout via progressive dividends & flexible buy‑backs

4‑2 Supporting Numbers (2020→2025)

- Sales CAGR +4 %

- Operating margin 5.9 % → 6.5 %

- ROE 12.4 % → 14.1 % (target)

- Net D/E 0.7× keeps leverage modest

4‑3 New Businesses & Alliances (examples)

- North America CVS: Farmy Convenience HD aiming for 1,000 outlets

- Digital Health: Partnership with Preferred Networks on AI inventory optimisation

- Renewables: 1 GW Australian wind JV (30 % stake, IRR 10 %)

4‑4 Key Risks & Severity

| Category | Risk | Severity |

| Commodity | Sharp oil/coal price drop | High |

| FX | Yen appreciation to ¥105/US$ | Medium |

| Cycle | US retail demand sensitivity | Medium |

| Regulation | ESG push forces coal asset exit | Medium |

| Competition | Convenience‑store margin squeeze | Low |

Note for Overseas Investors

Itochu’s consumer tilt buffers commodity swings better than peers, but JPY volatility and domestic retail rivalry still warrant monitoring.

⑤ Dividend Strategy: Stability & Upside

Key Takeaway

Itochu follows a “progressive plus add‑on” model. With nine straight dividend hikes, FY 2025 DPS rises to ¥200 (+¥20 YoY). Management promises at least flat dividends even in down years and sustains industry‑leading shareholder returns.

5‑1 Policy

Since declaring a progressive policy in FY 2014, Itochu has never cut. Guidance: total payout ratio 35–45 %; dividends held or raised even if earnings slip.

5‑2 DPS & Payout Trend

| FY | DPS (¥) | YoY | Payout |

| 2019 | 88 | +3 | 29 % |

| 2020 | 92 | +4 | 31 % |

| 2021 | 110 | +18 | 33 % |

| 2022 | 140 | +30 | 36 % |

| 2023 | 160 | +20 | 38 % |

| 2024 | 180 | +20 | 39 % |

| 2025* | 200 | +20 | ~40 % |

| *Company forecast |

5‑3 Buy‑Back Track Record

In FY 2024 the company executed a buy‑back of up to ¥300 bn (4.2 % of shares), tightening supply and boosting EPS. Management indicates spare cash will continue to be returned whenever possible.

5‑4 Dividend‑Cut Risk Test

Even if EPS halved, a 45 % payout would still cover ¥100 DPS thanks to a comfortable net D/E of 0.7×. Only a severe cash‑flow drop or major M&A deal might force a pause.

Note for Overseas Investors

Unlike many Japanese firms that vaguely promise “stable” dividends, Itochu caps total payout and pairs dividends with routine buy‑backs—a framework familiar to Western income investors.

⑥ PBR & Asset Quality: Truly Expensive?

Key Takeaway

A 1.8–1.9× PBR exceeds the peer average (~1.4×), seeming pricey. Yet a robust ≈14 % ROE plus hidden gains (prime real estate, listed stakes) justify a “quality premium.” Further re‑rating hinges on faster asset recycling and capital‑efficiency moves.

6‑1 PBR History

0.8× (2020) → 2.3× (2024 peak) → 1.85× now. Well above the 1.2× historical mean but defendable if ROE stays high.

6‑2 Balance‑Sheet Breakdown (FY 2025‑03, rough)

- Cash & deposits: ¥1.2 tn (13 %)

- Working capital: ¥1.8 tn (19 %)

- Listed/affiliates: ¥3.5 tn (37 %) FamilyMart 100 %; CITIC 23 %

- Real estate: ¥1.1 tn (12 %)

- Intangibles & goodwill: ¥0.3 tn (3 %)

- Other: ¥1.0 tn (16 %)

6‑3 Asset‑Quality Highlights

- Prime real estate: HQ sites in Kita‑Aoyama & Yodoyabashi carry 3–4× book gains

- Retail stake: Full ownership of FamilyMart provides stable cash flow

- China exposure: CITIC stake is cheap but subject to FX & governance risk

6‑4 Efficiency Drive

The company aims to divest ¥400 bn of non‑core assets annually, redeploying into projects with 10 %+ ROIC and supplementing this with buy‑backs to push ROE to 15 %.

Note for Overseas Investors

Japanese conglomerates book prime property at cost; headline PBR can understate look‑through value—but unlocking it requires disciplined disposals.

Disclaimer

The content on this website is for informational and educational purposes only and does not constitute financial, legal, or investment advice. The views expressed are the personal opinions of the author (DividendDan), based on experience as a strategy consultant and individual investor living in Japan.

Market data and company information are subject to change. Please conduct your own due diligence or consult a certified financial advisor before making any investment decisions. The author may hold positions in the securities mentioned.