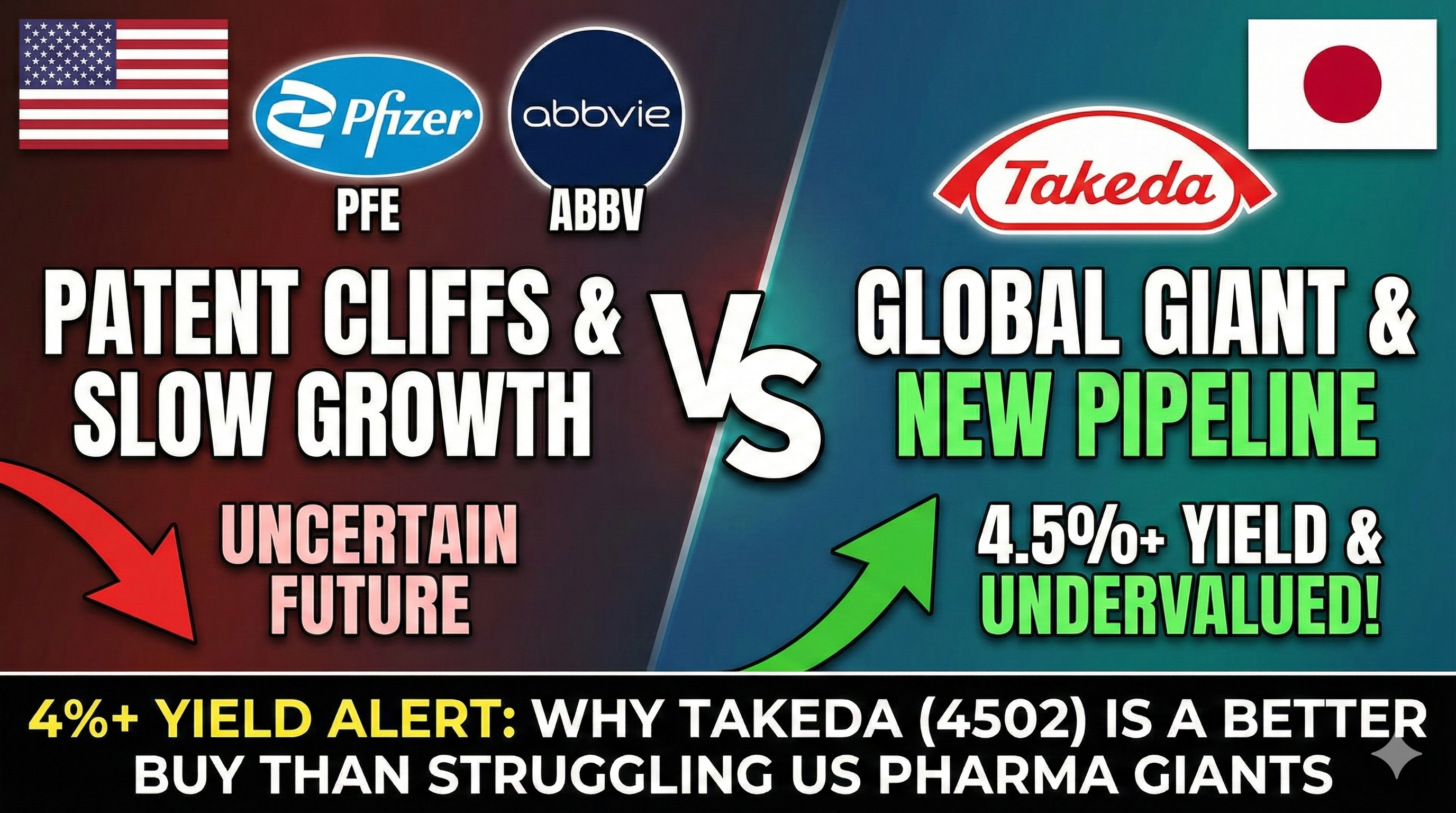

4%+ Yield Alert: Why Takeda (4502) is a Better Buy Than Struggling US Pharma Giants

Key Takeaways (TL;DR)

- ✅ More Than Japanese: Takeda is a true Global Pharma Giant (top 12 globally by revenue), generating over 80% of its sales outside Japan.

- ✅ Massive Yield: It offers a stable dividend yield of nearly 4.5%, often higher than peers like Pfizer or Johnson & Johnson.

- ✅ Undervalued Opportunity: Due to recent patent expiries, the stock is facing temporary headwinds, creating an attractive entry point for long-term income investors.

Introduction

US healthcare investors are facing a dilemma. You love the dividends from giants like Pfizer (PFE) or Bristol Myers Squibb (BMY), but their recent stock performances have been disappointing due to slowing growth and looming “patent cliffs.”

Are you looking for a global pharmaceutical giant that trades at a reasonable valuation and pays a massive 4%+ yield?

You need to look outside the US. Meet Takeda Pharmaceutical (TYO: 4502 / US ADR: TAK), Japan’s undisputed healthcare champion. Here is why Takeda deserves a spot in your high-yield portfolio right next to AbbVie.

1. A Global Giant in Disguise

Many US investors mistakenly think Takeda is just a “large domestic Japanese company.” This is completely wrong.

Takeda is one of the oldest companies in the world (founded in 1781!), but today, it is arguably the most “Westernized” company in Japan.

The “Un-Japanese” Japanese Company

Under its French CEO, Christophe Weber, Takeda aggressively acquired Shire Plc in 2019 for $62 billion, transforming itself into a global powerhouse. Their board is highly international, and the company culture operates more like a Boston biotech firm than a traditional Tokyo corporation.

- Global Revenue: Today, over 80% of Takeda’s revenue comes from outside Japan, with roughly half coming from the US market alone.

- Focus Areas: They are leaders in Gastroenterology (GI), Rare Diseases, and Oncology.

When you buy Takeda, you are buying a global diversified pharma major, not a Japanese local play.

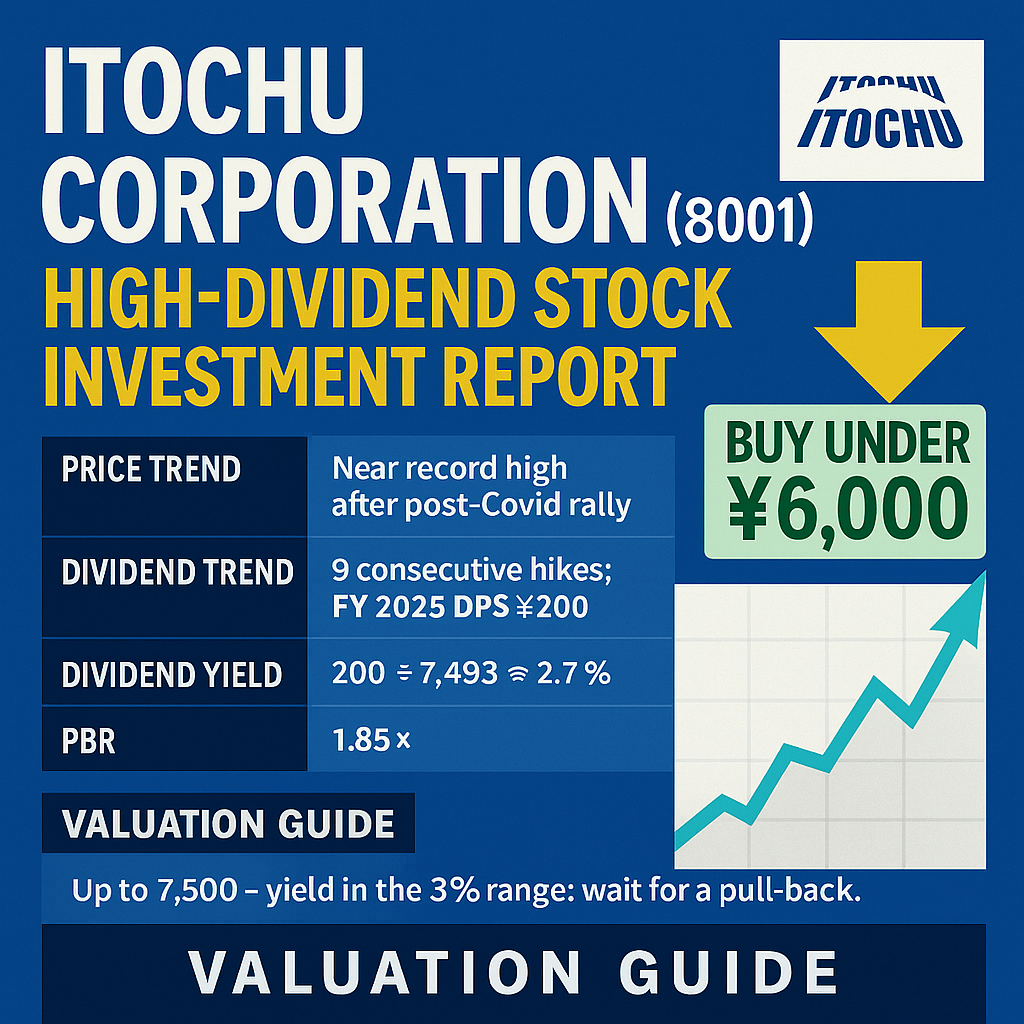

2. The Yield Monster (4%+)

This is what income investors care about most. Takeda is committed to high shareholder returns.

While US giants like Johnson & Johnson (JNJ) yield around 3.0% and Pfizer (PFE) yields around 6.0% (largely due to massive stock price drops), Takeda consistently offers a high and stable yield, currently sitting around 4.3% – 4.5% due to the Weak Yen and depressed stock price.

Takeda has a rigid policy of paying a stable dividend of ¥188 per share annually. They prioritize maintaining this payout even when earnings fluctuate due to R&D cycles. For income seekers, this commitment is golden.

3. The Opportunity: Why is it Cheap?

If Takeda is so good, why is the yield so high (and the price low)? Like AbbVie faced with Humira, Takeda is currently navigating its own patent cliffs for key drugs (like the ADHD drug Vyvanse). This has caused near-term earnings headwinds, scaring off growth investors.

However, the market is likely overreacting. Takeda has a robust pipeline of new drugs launching soon to replace lost revenue. For example, their new dengue fever vaccine, QDENGA, has potential blockbuster status globally.

The Value Proposition: You are getting the chance to buy a Global Top 12 pharma company at a depressed valuation, locking in a 4.5% yield while waiting for their new drug pipeline to deliver growth.

Conclusion: Diversify Your Pharma Income

Don’t put all your healthcare eggs in the US basket. Takeda (4502 / TAK) offers you essential diversification away from the US Dollar and US regulatory risks, all while paying you a hefty income.

With the historic Weak Yen providing an extra discount for dollar-based investors, now is the time to add some Japanese resilience to your portfolio.

Disclaimer

The content on this website is for informational and educational purposes only and does not constitute financial, legal, or investment advice. The views expressed are the personal opinions of the author (DividendDan), based on experience as a strategy consultant and individual investor living in Japan.

Market data and company information are subject to change. Please conduct your own due diligence or consult a certified financial advisor before making any investment decisions. The author may hold positions in the securities mentioned.