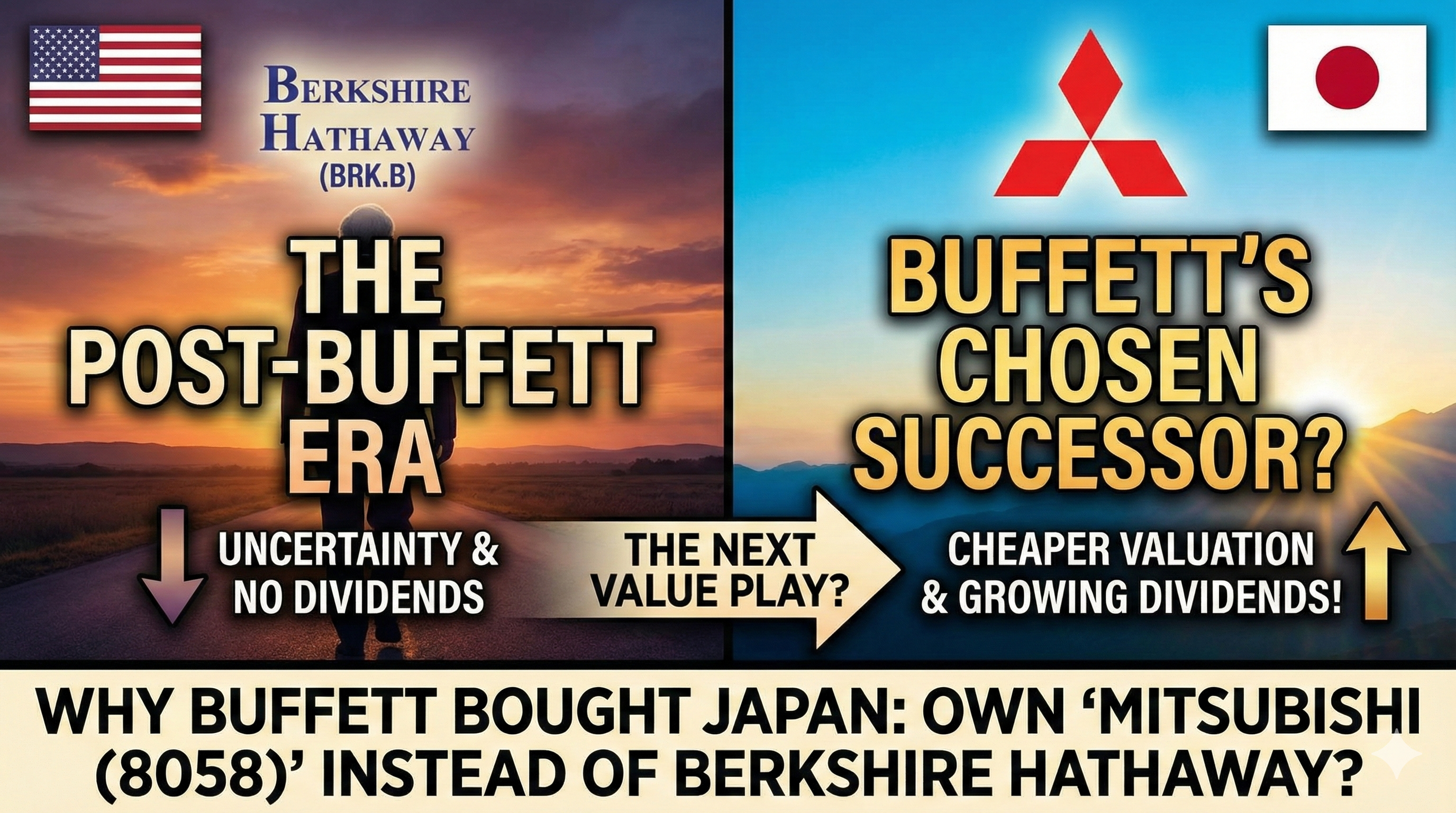

Why Buffett Bought Japan: Own “Mitsubishi (8058)” Instead of the Post-Buffett Berkshire?

Key Takeaways (TL;DR)

- ✅ The “Mini-Berkshire” Model: Japan’s trading houses like Mitsubishi Corp are diversified investment conglomerates holding stakes in energy, infrastructure, and finance—exactly the business model Buffett loves.

- ✅ The Post-Buffett Reality: With Warren Buffett retired, Berkshire Hathaway faces uncertainty and the potential loss of its “Buffett Premium.” Mitsubishi, however, relies on systematic management, not a single charismatic leader.

- ✅ Better Value & Income: Mitsubishi still trades at a much cheaper valuation (lower P/B) than Berkshire and offers a growing “progressive dividend,” unlike Berkshire’s zero payout.

Introduction

Every serious investor knows that Warren Buffett shocked the world by investing billions into Japan’s five largest trading houses, including Mitsubishi Corporation (TYO: 8058 / US OTC: MSBHF).

But in the new “Post-Buffett Era,” understanding why he did this is more critical than ever.

With the legendary Oracle having stepped aside, Berkshire Hathaway (BRK.B) faces its biggest existential question. Investors are anxiously asking: “Can the magic continue without Warren?”

Meanwhile, the companies Buffett personally hand-picked in Japan are thriving. Here is why smart investors are realizing that owning Mitsubishi Corp (8058) might now be a better bet than owning Berkshire Hathaway itself.

1. The “Mini-Berkshire” Model (A System, Not a Man)

To most Americans, a “trading house” sounds like a low-margin middleman business. This is a massive misunderstanding.

Think of Mitsubishi Corporation as a diversified investment holding company, just like Berkshire.

- Berkshire holds: Insurance (GEICO), Railroads (BNSF), Energy plants, and Consumer Goods.

- Mitsubishi holds: Energy projects (LNG), Metal mines (copper), Infrastructure, and Retail chains (Lawson).

The Critical Difference: Berkshire’s success was heavily dependent on Buffett’s singular genius for capital allocation. Mitsubishi, and Japan’s trading houses, are run by systems and organizational structures built over decades. They do not rely on one charismatic leader. They are essentially a “Berkshire model that runs on autopilot.”

2. The Valuation Gap: Why Pay the “Buffett Premium”?

For decades, Berkshire Hathaway’s stock traded at a premium because investors were willing to pay up for having Buffett at the helm.

Now that he is retired, should that premium still exist?

- Berkshire Hathaway (BRK.B): Still often trades at a premium valuation (P/B ~1.5x), reflecting past glory.

- Mitsubishi Corp (8058): Buffett bought them when they were trading below book value (P/B < 1.0x)—essentially buying $1.00 of assets for $0.80. Even today, they trade at significantly lower valuations than Berkshire.

By buying Mitsubishi, you are buying high-quality assets at a discount, without paying the lingering “Buffett Premium.”

3. The Deciding Factor: Dividends

This is where Mitsubishi wins for income investors, especially now. Buffett famously never paid a dividend.

Mitsubishi Corporation, on the other hand, has adopted a “Progressive Dividend Policy.” This means they pledge not to cut the dividend and aim to increase it over time as profits grow.

In a post-Buffett world, would you rather own a mature giant that pays you nothing to wait, or a cheaper, growing conglomerate that pays you a rising income stream?

Conclusion: The Student Has Become the Master?

Berkshire Hathaway is an incredible company, but it is entering an era of uncertainty. Mitsubishi Corporation is applying the exact same proven business model—diversified cash flows reinvested for growth—but with a systematic approach, a cheaper price tag, and a reliable dividend.

Perhaps the smartest way to honor Buffett’s legacy is not to buy his old company, but to buy the companies he recognized as the future of value investing. Mitsubishi Corporation (8058 / MSBHF) is that future.

Disclaimer

The content on this website is for informational and educational purposes only and does not constitute financial, legal, or investment advice. The views expressed are the personal opinions of the author (DividendDan), based on experience as a strategy consultant and individual investor living in Japan.

Market data and company information are subject to change. Please conduct your own due diligence or consult a certified financial advisor before making any investment decisions. The author may hold positions in the securities mentioned.